FINANCIAL SECURITY FOR YOU AND YOUR LOVED ONES

Whether you are an individual looking for that financial peace of mind or a business owner looking to provide some staff benefits or protect shareholders and key individuals, we can help you with all of the following:

1. LIFE INSURANCE

You can leave behind a lump sum to help pay for things such as, funeral costs, pay off your mortgage or just to help your loved ones with living costs. It can also be structured as a group policy for staff.

2. CRITICAL ILLNESS COVER

Critical Illness Cover can help provide peace of mind to know that a lump sum will be paid in the event of diagnosis of an eligible critical illness. Common uses of the lump sum could be to supplement income, pay off debt or make alterations to the house depending on the severity of the condition. It can also be structured as a group policy for staff.

3. INCOME PROTECTION

Income Protection can help provide you with a regular income should you not be able to work due to sickness or disability. It can also be structured as a group policy for staff.

4. PRIVATE HEALTH INSURANCE

Private Health Insurance can help pay for the medical treatment you need at a time you need it without having to rely on the NHS and long waiting lists. It can also be structured as a group policy for staff.

5. SHAREHOLDER PROTECTION

Shareholder Protection can provide a lump sum should the worst happen to one of the shareholders.

6. KEY PERSON PROTECTION

6. KEY PERSON PROTECTION

“WHO KNEW GETTING A MORTGAGE AND LIFE INSURANCE COULD BE STRESS-FREE?”

I was under the impression that buying a house was stressful, how wrong I was! I’ve toyed with the idea of buying my first home on a number of occasions and Colin has always been on hand to offer any advice I needed or any documentation that I needed to provide. Back in March 2020, I’d found the home I wanted and the first person I spoke to about it was of course Colin, he explained what I needed to do to make this work, come August 2020 when I needed my approval in principle I made one phone call and within 24 hours I’d received it and I was then able to reserve the home I wanted, all thanks to Colin.

I also had a great experience when dealing with Jessica Robinson again from AKORN Financial Advice who dealt with my life insurance and critical illness cover who again was on hand to answer any questions or queries I had.

Thank you so much and of course, I would not hesitate to recommend Colin Taylor and the team at AKORN Financial Advice.

J Yates

SIGN UP TO OUR NEWSLETTER

ARE YOU READY TO REACH YOUR GOALS?

Call or email us today:

01254 584330

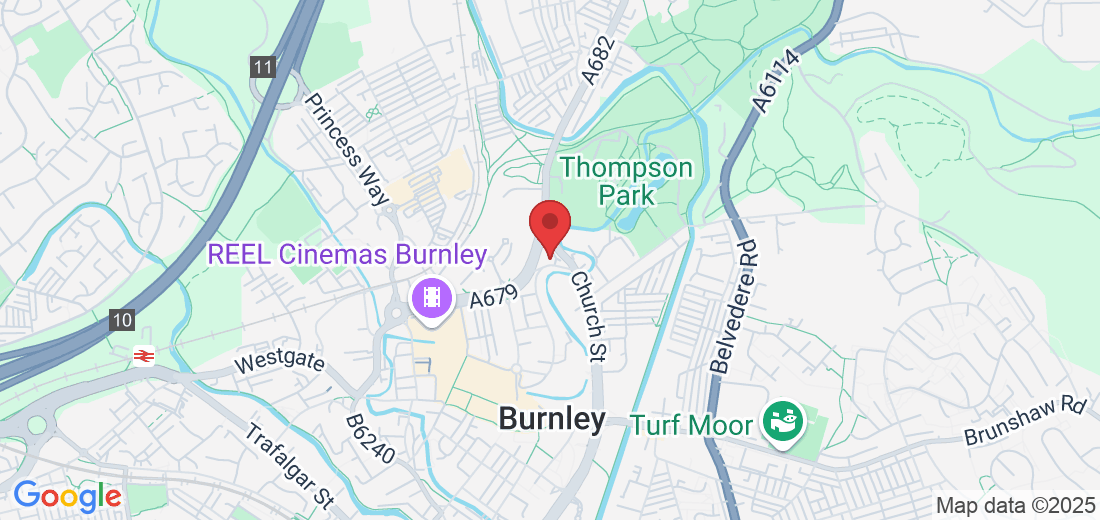

The Landmark, School Lane, Burnley, BB11 1UF

MAKE AN ENQUIRY

Fill in the form and one of our team will be in touch within 48 hours.

Before you supply any personal details to us via the contact us page on this website please read our customer privacy notice document (which can be found here). This notice sets out how we will process your personal data in line with the General Data Protection Regulations. By submitting your enquiry you confirm that you have read the customer privacy notice and that you agree to AKORN Financial Advice Ltd processing your personal information for the purpose of contacting you.

AKORN Financial Advice Limited is registered in England and Wales no. 09326613. Registered office, The Landmark, School Lane, Burnley, BB11 1UF

Authorised and regulated by the Financial Conduct Authority. AKORN Financial Advice Limited is entered on the Financial Services Register https://register.fca.org.uk/ under reference 846158. If you wish to register a complaint, please write to us at the address above or email us at [email protected]

A summary of our internal procedures for the reasonable and prompt handling of complaints is available on request and if you cannot settle your complaint with us, you may be entitled to refer it to the Financial Ombudsman Service at www.financial-ombudsman.org.uk or by contacting them on 0800 0234 567.